If you’re wondering, can a landlord charge for painting in Illinois or Chicago, you’re not alone. Painting deductions are among the most common – and misunderstood – security deposit issues. Landlords often claim they had to repaint because of “damage,” but in many cases, they’re really just doing routine maintenance. So the big question is: can your landlord charge you for painting?

Under Illinois law, including tenant-protective ordinances in Chicago and Cook County, the answer depends on what caused the need for paint in the first place. If the walls were damaged beyond normal wear and tear, a deduction might be allowed. But if the walls simply show signs of everyday use – like light scuffs, nail holes from hanging pictures, or fading paint – then your landlord cannot legally charge you for painting.

This article will walk you through the rules for when landlords can (and can’t) deduct painting costs from your deposit, how “ordinary wear and tear” is defined, and what your rights are if you live in Cook County. We’ll also cover lease terms, local ordinance protections, and why depreciation matters. By the end, you’ll know how to evaluate your situation and whether you may have a claim.

Let’s start with the foundation: what actually qualifies as ordinary wear and tear?

Key Takeaways

- Landlords cannot deduct for ordinary wear and tear – including nail holes, minor scuffs, fading paint, or damage from cheap flat paint. These are not valid reasons to withhold a security deposit.

- Painting charges must reflect depreciation. If the paint was near or past its useful life, the landlord cannot charge the full cost – and often can’t charge at all.

- Even if the lease says you’re responsible for repainting, the law still controls. Landlords can’t contract around tenant protections.

- If your landlord deducted for painting, talk to a security deposit attorney. Brabender Law handles these cases on contingency, and early legal help can make all the difference.

What Is Ordinary Wear and Tear?

Ordinary wear and tear refers to the natural and expected deterioration of a rental unit and its fixtures over time, resulting from a tenant’s normal use of the premises, without misuse or abuse. This includes minor damage caused by time, usage, and environmental factors, even if the tenant didn’t cause them intentionally.

Why does this definition matter? Because under Illinois law – and nearly every lease you’re likely to sign – landlords can only deduct from your security deposit for damage that goes beyond ordinary wear and tear. Most leases include language that limits deductions to things like unpaid rent or damage, and even when they don’t, state and local law fill the gap. Landlords are not allowed to treat your deposit like a blank check for touch-ups and cosmetic upgrades.

Here are some common examples of ordinary wear and tear that should not justify a painting charge:

- Small nail holes from hanging pictures or art

- Scuff marks from furniture or daily traffic

- Fading paint or uneven color from sunlight or age

- Minor nicks or gouges in drywall from normal use

- Marks where furniture rubbed against walls

- Approved modifications like a wall-mounted TV, assuming you had permission

In contrast, landlords sometimes charge for more noticeable or unusual issues, such as:

- Large holes or cracked drywall that requires repair

- Permanent stains, crayon drawings, or writing on the walls

- Unapproved alterations that left behind damage

- Full wall murals – yes, really. We’ve seen it twice. One was basically finger paint, the other was brushed by Michaelangelo himself. In both cases, the landlord wanted the tenant to pay to cover it up.

The key is whether the condition of the wall goes beyond what’s reasonable for a lived-in unit. If not, the painting charge is probably illegal.

Next, let’s look at what Illinois law and local rules actually say about painting deductions.

Can a Landlord Charge for Painting Under Illinois Law?

If your landlord deducted painting costs from your security deposit, the first question to ask is whether the deduction complies with the law. In Illinois, landlords can only charge tenants for property damage beyond ordinary wear and tear. That’s true statewide under the Illinois Security Deposit Return Act, and it’s even more strictly enforced in places like Chicago and suburban Cook County.

Illinois Security Deposit Return Act (SDRA)

As of 2024, the SDRA applies to all residential units in Illinois, regardless of building size. Landlords can only deduct for unpaid rent or damage beyond ordinary wear and tear. If they charge for painting, they must:

- Provide an itemized list of the damage within 30 days of move-out

- Provide paid receipts (or estimates followed by receipts within another 30 days)

- Return any remaining deposit within 45 days

If they skip any of these steps or make deductions in bad faith, tenants can sue for two times the amount owed, plus attorney’s fees and court costs.

So, can a landlord charge for painting in Illinois under the SDRA? Only if the repainting was needed because of damage beyond ordinary wear and tear and only if they follow the steps laid out in law.

Learn more about Illinois security deposit law →

Chicago RLTO

If your rental unit is in Chicago and covered by the RLTO, the law gives you strong post-move-out protections. Painting charges are only legal if the damage goes beyond ordinary wear and tear, and landlords must:

- Provide an itemized list of deductions within 30 days

- Provide paid receipts for the repairs (or follow up with receipts if estimates were given)

- Return the balance of the deposit, plus final interest, within 45 days

A landlord who violates these rules is liable for two times the deposit, plus return of the deposit and attorney’s fees.

Learn more about Chicago security deposit law →

Cook County CCRTLO

For tenants in suburban Cook County (outside Chicago), the CCRTLO often applies. The rules closely mirror Chicago’s: landlords can only deduct for damage beyond ordinary wear and tear, must provide an itemized list within 30 days, and must follow up with receipts if necessary. Any deposit balance must be returned within 30 days.

Landlords who violate these rules face a penalty of two times the deposit, return of the deposit, and attorney’s fees.

Learn more about Cook County security deposit law →

Other local ordinances

- Urbana: Painting charges are only allowed if the walls were damaged beyond ordinary wear and tear. Simply needing to repaint for the next tenant is not enough.

- Mount Prospect: Painting charges are specifically barred unless the lease says the tenant was required to repaint on move-out – and most leases don’t say that.

In short, whether you live in the city, the suburbs, or downstate, your landlord cannot deduct painting costs from your deposit just because they always repaint or want a “fresh look.” They must show that you caused actual damage.

Next, we’ll look at some common landlord arguments – and how to respond when they don’t hold up.

Landlord Arguments That Don’t Hold Up

When landlords charge tenants for painting, they often rely on familiar excuses. Some of them sound reasonable – until you realize the law doesn’t care about the landlord’s habits, preferences, or renovation goals. Here’s how the most common arguments fall apart:

“We always repaint between tenants”

That may be true. But landlords choosing to refresh the unit doesn’t give them the right to make you pay for it. Repainting as part of routine turnover is a business expense, not your financial responsibility. The law only allows deductions for actual damage – not cosmetic preferences. Just because your landlord likes things pristine doesn’t mean you owe them a dollar.

“The whole unit had to be painted”

Even if part of a unit was damaged, landlords cannot justify charging for repainting every room unless every room was actually damaged. If only one bedroom wall had crayon marks and the rest of the unit was normal, charging for a full-unit paint job is likely illegal. The law requires deductions to be reasonable and limited to actual costs tied to damage.

“You mounted a TV on the wall”

If the landlord gave you permission – especially in writing – to mount a TV or make other changes, they usually can’t bill you for restoring the wall. That’s part of the deal. If the wall was trashed or the tenant failed to patch holes when agreed upon, that may be different. But a standard install done with permission shouldn’t trigger a painting deduction.

“There were scuffs, scratches, and faded paint”

These are textbook examples of ordinary wear and tear. Furniture rubs against walls. Paint fades. Life happens. Landlords cannot charge you for repainting just because the unit looked lived-in after your lease ended.

“There were nail holes and small gouges”

Tiny nail holes from picture frames and light dings in the wall fall under ordinary wear and tear. Unless the wall looked like a dartboard or drywall was visibly damaged, these do not justify a deduction. Courts recognize that tenants hang things on walls – and landlords need to patch and paint as part of regular turnover.

“It cost $8,000 to paint the unit”

Some landlords get wildly creative with their invoices. One moment, it’s a basic one-bedroom – the next, it’s a full-scale restoration project worthy of a museum wing. We’ve seen more than a few repainting charges that raised eyebrows. A landlord might claim it cost $10,000 to paint a small apartment – and that the work was done by Kyle J. Sanderson, a “professional” painter who, upon closer inspection, turns out to be the landlord’s 15-year-old son who mostly paints Warhammer figurines in the garage. We’re not saying that’s ever actually happened. Just… ask questions when the numbers get ridiculous.

“You painted a mural”

I know, I know – maybe the walls needed some personality. But murals are almost never worth the fight. Whether it’s a shaky skyline or a pretty solid attempt at a jazz club scene, unapproved wall art usually gets you dinged. I’ve only seen two in real cases, and I still think about them. And no, I’m not letting the muralists off the hook.

Up next: let’s talk about the elephant in the room – paint doesn’t last forever. So why are landlords trying to charge tenants for full replacement?

Depreciation and Useful Life of Paint

This is the issue that comes up the most in painting-related deposit disputes – landlords charging full price to repaint, even when the paint was years old and clearly due for replacement. It’s one of the most common, and most frustrating, tactics we see. And unfortunately, many tenants just assume it’s allowed.

Paint Doesn’t Last Forever

Let’s be clear: paint has a shelf life. It wears down. It fades. It gets scuffed. And at some point, repainting becomes basic maintenance – not something the tenant should be footing the bill for.

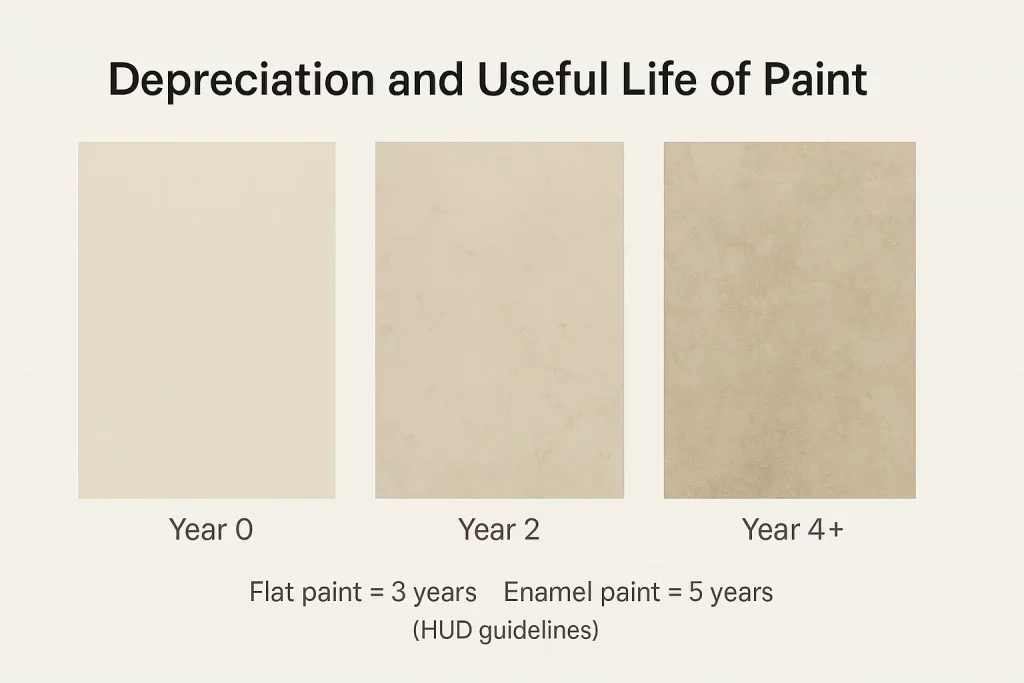

The U.S. Department of Housing and Urban Development (HUD) considers the useful life of interior flat paint to be 3 years and enamel paint around 5 years. That means if the paint was already a few years old when you moved in – or if you lived there for more than a year or two – it’s likely the landlord was due to repaint soon anyway.

So, can a landlord charge for painting if the paint is already past its useful life? In most cases, the answer is no.

Why Are Landlords Using Flat Paint?

To make matters worse, many landlords opt for flat paint – the least durable and most scuff-prone finish available. It marks if you breathe on it, and touch-ups never match. Why use it? Probably because it’s cheap. But just because flat paint turns a wall into a smudge magnet doesn’t mean you should pay to repaint it.

Only the Remaining Value Counts

Here’s the legal bottom line: if the paint has passed its useful life, the landlord can’t charge you for it. If the paint still had some time left, they can only charge for the remaining value – not the full job. For example, if a wall needed repainting after two years of a three-year life expectancy, they can at most try to recover one-third of the cost. And only if the repainting was required because of actual damage, not ordinary wear.

Even the IRS doesn’t treat interior paint as a capital improvement. That’s right – the federal government doesn’t think it adds long-term value to a property. It’s just upkeep. So when a landlord charges you like they’re investing in real estate equity, the law usually isn’t on their side.

But what if your lease says you’re responsible for repainting? Or claims the landlord can charge you for any “repairs” they deem necessary? Let’s look at what lease language can and can’t legally do when it comes to security deposit deductions.

Lease Clauses and Tenant Responsibilities

Sometimes landlords point to a clause in the lease as justification for painting deductions. It might say the unit must be returned in the same condition, or that the tenant is responsible for “repairs,” or that any damage – however minor – will be deducted from the deposit. But even if your lease says something along those lines, it doesn’t override Illinois law.

The Lease Doesn’t Trump the Law

In Illinois, leases can’t legally allow landlords to deduct for ordinary wear and tear. If a clause appears to give the landlord that power, courts generally won’t enforce it. The same applies in Cook County and Chicago, where local ordinances make clear that only damage beyond ordinary wear and tear justifies a deduction.

So if your lease says you’re responsible for repainting, that clause is only enforceable if the repainting was required because you damaged the walls – not because the paint was old, faded, or marked up from normal use.

Watch Out for Vague or One-Sided Language

Some leases try to sneak in vague language that gives landlords broad power to make deductions. Others include one-sided attorney’s fees clauses, or require tenants to “restore” the unit to move-in condition. Courts often see through this, especially when the terms are unclear or contradict state and local law.

That said, leases do matter. If the lease included specific instructions about approved modifications, painting, or returning the unit in a certain condition, those details may affect your claim. But the bottom line is this: no lease can give a landlord more power than the law allows.

Up next: what you can do to protect yourself – and how to challenge an improper deduction.

How Tenants Can Protect Themselves

Even if your landlord is less than cooperative, there are practical steps you can take to protect your deposit from improper painting charges. The key is to preserve evidence and avoid doing anything that might weaken your legal position later.

Document the Condition of the Unit

Before you move in, take clear, time-stamped photos or videos of every room. Make sure to include the condition of the walls – scuffs, nail holes, existing damage, everything. Do the same when you move out. If the landlord later claims you trashed the place, your documentation may be the only thing standing between you and a bogus charge.

Use any move-in checklist the landlord provides, or create your own and email it to them. The goal is to show what the unit looked like when you arrived – and when you left.

Get Modification Approvals in Writing

If you plan to hang anything heavier than a picture frame – like a mounted TV or shelving – get written permission. A short email exchange is fine. Without it, landlords often claim these changes were unapproved damage. With it, they’ll have a harder time justifying deductions.

Don’t Try to Negotiate the Deposit Yourself

It might be tempting to demand receipts or argue with your landlord directly, but doing so can backfire. In many cases, a tenant’s claim becomes stronger if the landlord fails to follow legal procedures – like providing a timely itemized list or paid receipts. If you think a deduction is improper, your best move is to talk to a qualified security deposit attorney as soon as possible.

At Brabender Law, we handle security deposit claims on a contingency basis – meaning you don’t pay unless we recover money for you. And we’ve seen too many tenants hurt their cases by trying to negotiate or challenge the landlord on their own. Click here to request a case evaluation.

Think Your Landlord Charged You Illegally for Painting?

If your landlord deducted painting costs from your security deposit, and you’re in Cook County, you may have a strong legal claim. Brabender Law handles security deposit disputes on contingency – meaning you don’t pay unless we recover money for you.

Don’t let your landlord renovate on your dime. Contact us today for a free consultation and find out if you’re owed double your deposit.